PropNex Picks

|September 11,2025October Showdown: Can the Market Absorb 5 Launches at Once?

Share this article:

October 2025 is shaping up to be one of the busiest months for Singapore's private property market in recent memory. In fact, it's rare to see five significant projects all jostling for attention within the same month.

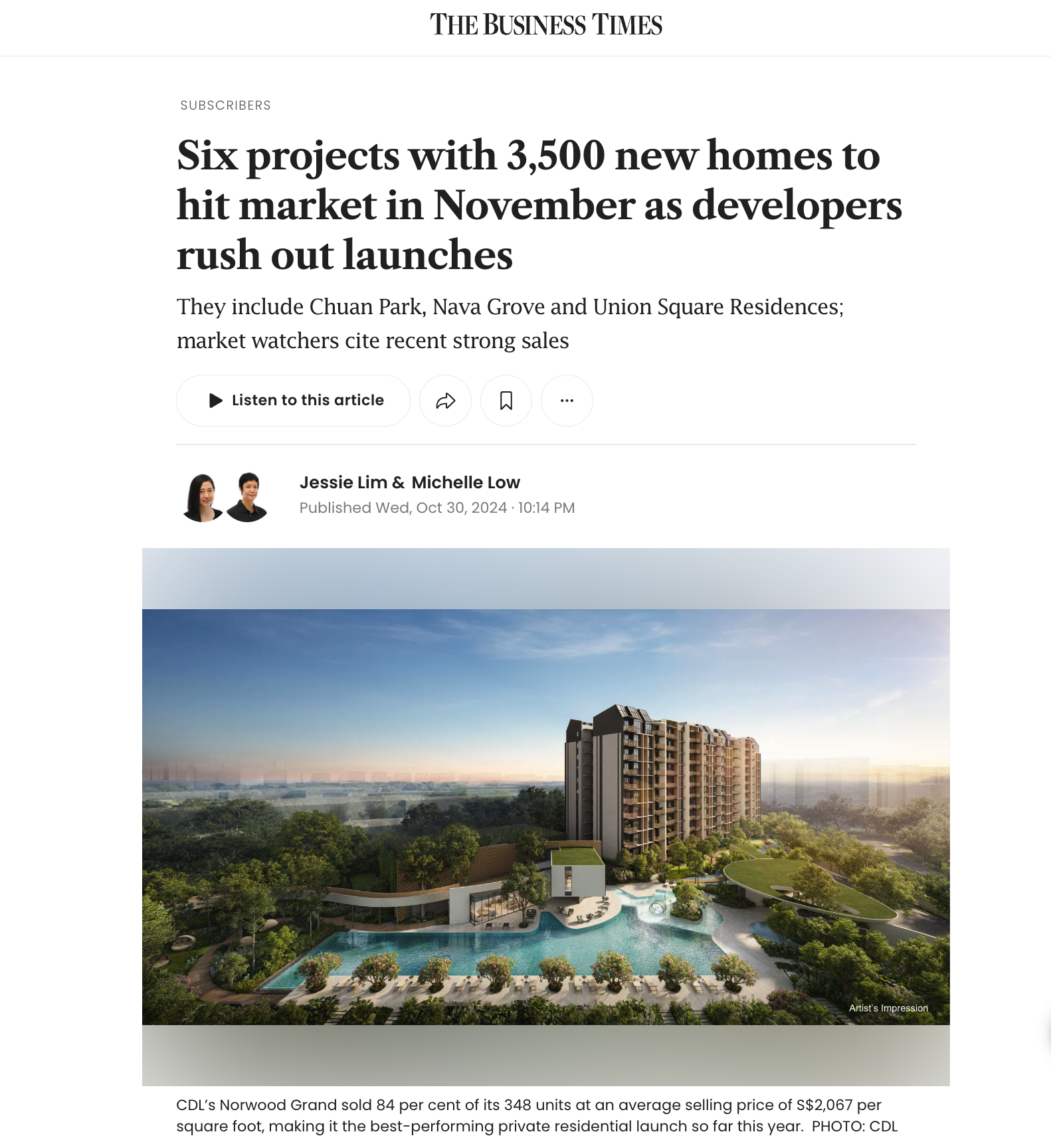

The last time we saw a similar surge was in November 2024, when six major new launches hit the market with more than 3,500 units released in a single month, and 2,557 units sold - a sharp jump compared to just 738 units in October 2024.

Source: Business Times coverage of the November 2024 surge in new launches.

With Skye at Holland, Faber Residences, Penrith at Margaret Drive, Zyon Grand, and The Sen all tentatively previewing within weeks of each other, buyers will be spoilt for choice, while developers brace for a competitive sales race. The question is: will October see a repeat of that success, or will some projects be left fighting for attention?

Before diving into the details of each launch, it's worth taking a step back to consider why October's line-up matters. Five projects entering the market almost simultaneously is rare, and it raises the stakes for both developers and buyers.

For developers, the challenge is differentiation - how to stand out in a crowded month. For buyers, it's about clarity - understanding which project best suits their lifestyle and investment goals. With that in mind, here's a closer look at each development.

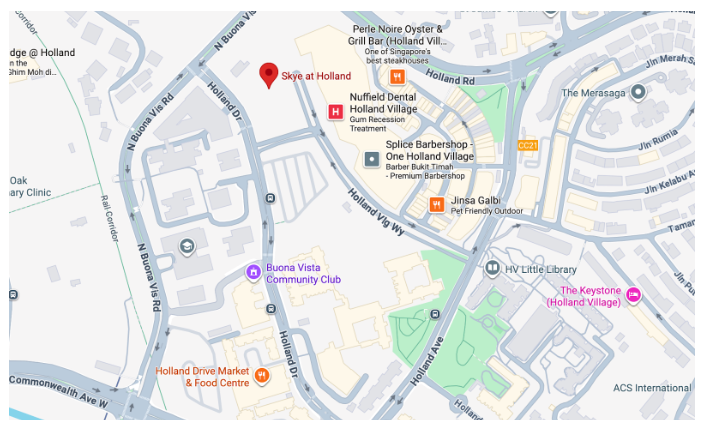

Skye at Holland: 99-years leasehold, Holland Drive, D10 CCR, 666 units, 27 September - 7 October

Penrith: 99-years leasehold, Margaret Drive, D3 RCR, 462 units, 3 October - 14 October

Zyon Grand: 99-years leasehold, Zion Road, D3 RCR, 706 units, 17 October - 28 October

Faber Residence: 99-years leasehold, Faber Walk, D5 OCR, 399 units, 3 October - 14 October

The Sen: 99-years leasehold, Jalan Jurong Kechil, D21 RCR, 347 units, TBC October

That's more than 2,500 units entering the market within a single month - no small number by any standard, and enough to rival the blockbuster launch month of November 2024.

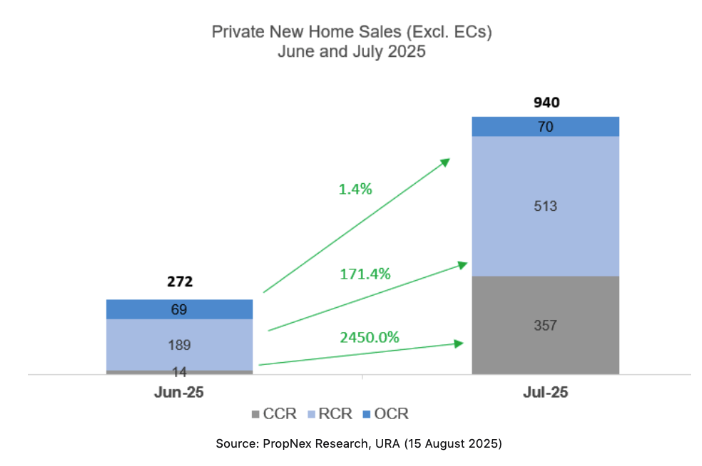

Interest rates have started easing, and government policies in recent months have nudged confidence back into the market. July 2025 already saw new private home sales rebound to a five-month high, with 976 units transacted, driven mainly by strong demand in the CCR and RCR projects. This momentum suggests buyers are returning with confidence.

There's also pent-up demand from buyers who delayed purchases earlier this year, plus the ever-reliable upgrader pool. Still, with five major launches so close together, the key question is not if units will move, but how quickly and which ones will dominate.

While it looks like a head-to-head clash, each project is subtly angled at different buyer pools, targeting very different aspirations and budgets. For consistency, this section will focus on comparing 3-bedroom units, as they are generally the ideal size for most homeowners, whether upgraders or first-time buyers:

Skye at Holland

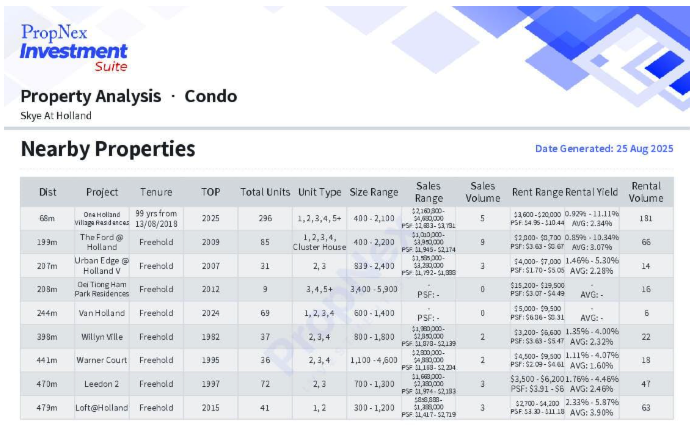

Investors and prestige buyers eyeing CCR luxury, particularly those who value long-term exclusivity in a mature prime district. Recent trends also show that Singapore's luxury condos have been gaining traction quietly, with CCR sales hitting multi-year highs, underscoring resilient demand for prime development.

Located right beside One Holland Village and just minutes from Holland Village MRT, Skye at Holland enjoys enviable connectivity and access to vibrant F&B and retail offerings, though the area has seen some shifts recently, with a few restaurants closing and a softer nightlife scene compared to its heyday. That being said, recent transactions highlight its premium appeal: at One Holland Village Residences, a sub-sale unit was sold for $4,680,000, compared to a similar-sized unit that went for $3,888,388 in 2019. Rental yield in the area hover between 1.6% and 3.9%, suggesting a strong leasing market for investors.

Other nearby projects like Van Holland and Leedon 2 also offer some reference points, though being older freehold developments with smaller unit sizes, they are not directly comparable to Skye at Holland, which is a newer 99-year leasehold development. That said, they still provide a rough gauge of market expectations in the Holland vicinity, helping to frame where Skye at Holland could be positioned.

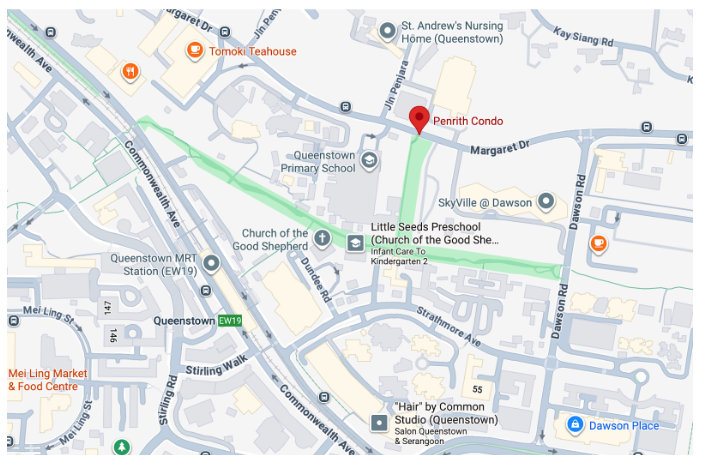

Penrith

Families seeking city-fringe convenience, backed by Queenstown's proven track record of strong rental demand and healthy resale performance. Its location along Margaret Drive offers proximity to Redhill MRT, Alexandra business hub, and reputable schools, making it attractive for both own-stay buyers and long-term investors. Past launches in this area have seen healthy demand, reflecting confidence in the Queenstown corridor as a growth hotspot.

According to our database, nearby projects provide useful benchmarks. Queens Peak has transacted at the start of this year, a unit at $2,410,000. A similar sized unit transacted at $1,705,000 in 2016. Similarly, Commonwealth Towers transacted a unit at the end of August at $2,588,800. A similar sized unit transacted at $1,715,100 in 2016.

Rental yields across the developments average around 3.3% to 3.6%, underscoring the appeal of this location for investors as well as homeowners. More importantly, the data shows steady capital appreciation in this precinct over the past decade, which helps prospective buyers see how Penrith could be a safer bet. For those weighing their options in October, these benchmarks suggest that Penrith may offer a more balanced combination of growth potential and rental resilience, giving it an edge over some of the other launches.

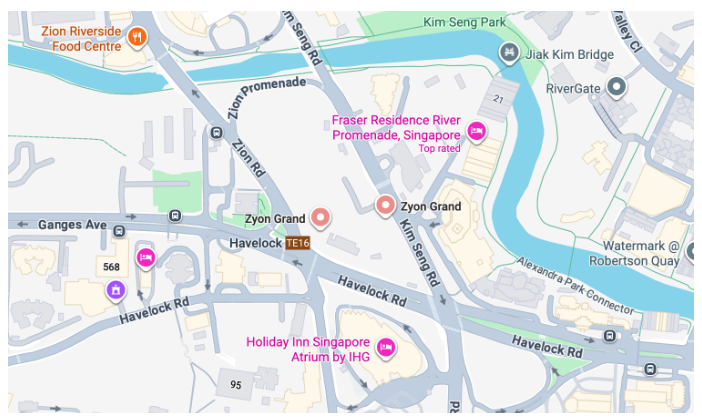

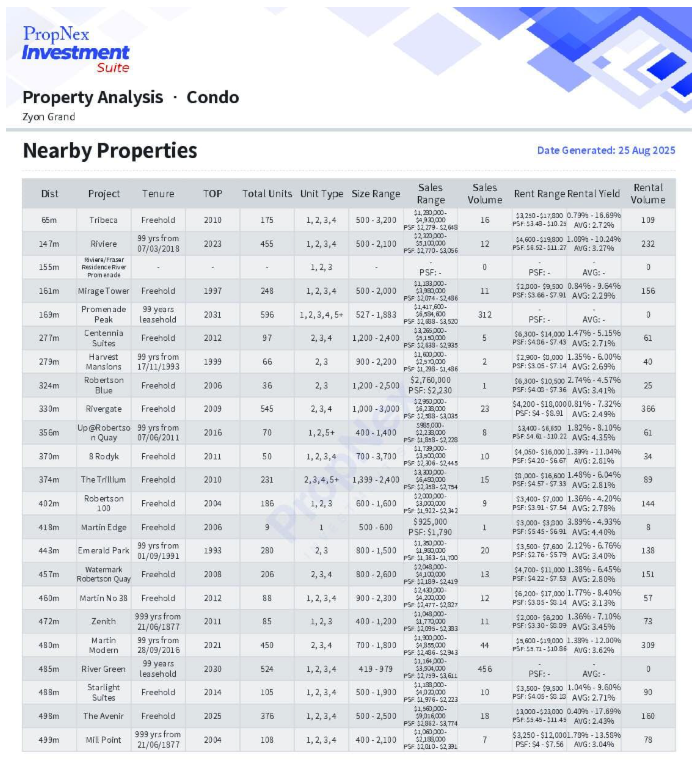

Zyon Grand

Investors and high-net-worth buyers attracted to central D3 rental prospects, with its scale offering extensive facilities that could further enhance appeal. Located along Zion Road, the development enjoys proximity to Orchard, Robertson Quay, and the Singapore River lifestyle precinct. Its large unit count suggests comprehensive facilities, including a retail podium with F&B, shops, and likely a childcare centre and supermarket downstairs. Added to that is Great World City just a 6-minute walk away, making it attractive for families and reinforcing its rental appeal.

Based on nearby project data, Rivire has transacted units at $3,250,000 - $3,680,000. Back in 2019, similar-sized units in the same development went for $2,770,160 - $3,588,030, showing clear price growth over the past few years. Not too far away, The Trillium has achieved $4,650,000 - $4,888,888 in the past year, while newer launches like The Avenir are trading between $3,488,000 - $3,700,000.

Rental yields in this area generally hover around 2% - 4%, reflecting steady investor demand despite high entry prices. It's also worth noting that Zyon Grand will feature long-stay service apartments, as required under the land tender conditions. For buyers, this suggests that Zyon Grand is entering a market with proven capital appreciation and resilient rental demand. Adding to its appeal, the project will also sit right beside Havelock MRT station on the Thomson-East Coast Line (TEL), enhancing connectivity to Orchard, Shenton Way, and the East Coast region. Taken together, these benchmarks help frame Zyon Grand's value proposition - a development with scale, strong location fundamentals, and evidence from nearby projects that growth is already baked into the area.

Faber Residences

Price-conscious upgraders who prefer OCR living, where entry prices are lower than CCR and RCR yet still enjoy decent connectivity and family-friendly amenities. Situated in the established Faber Walk enclave, the project offers a quieter, more residential setting, yet it is well-connected to the city via AYE. Its more modest scale compared to mega launches could appeal to those who value balance between community feel and modern condo living.

The area is also set to benefit from upcoming transport expansions. By 2027/8, the Jurong Region Line will bring the new Pandan Reservoir MRT station within walking distance of the project. From there, it's only one stop to Jurong East - often referred to as Singapore's "second CBD" thanks to its concentration of malls and offices. This connection also links residents to the North-South Line and East-West Line, opening direct access to key growth nodes such as Jurong Lake District and Jurong Innovation District, both major centres for jobs and education in the West.

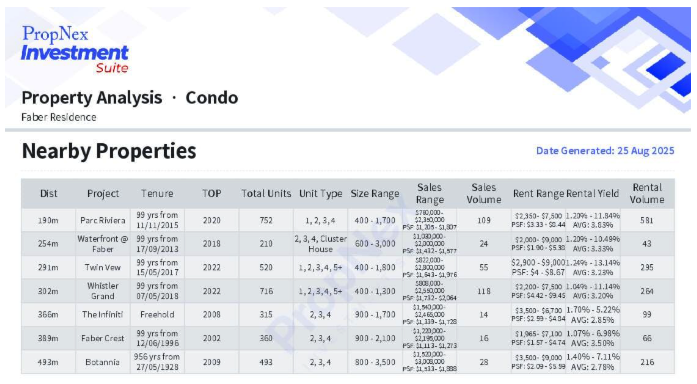

Looking at nearby projects helps to frame where Faber Residences might sit in the market. Parc Riviera, for example, last transacted in April for $1,788,888, compared to $1,100,000 back in 2016. Whistler Grand moved a unit in January for $2,200,000, up from $1,417,600 in 2018. Even older projects like Faber Crest are holding at around $1,528,000 - $1,600,000 despite being nearly three decades old with only 70 years remaining on the lease. This steady upward trend shows clear capital appreciation across the West Coast precinct, suggesting that Faber Residences could ride on the same trajectory.

Rental yields here are generally healthier than CCR, averaging around 3 - 4% thanks to steady upgrader and family demand. For buyers, this means Faber Residences presents a relatively affordable OCR entry point with room for long-term growth, making it a compelling option for upgraders who want both value and upside.

The Sen

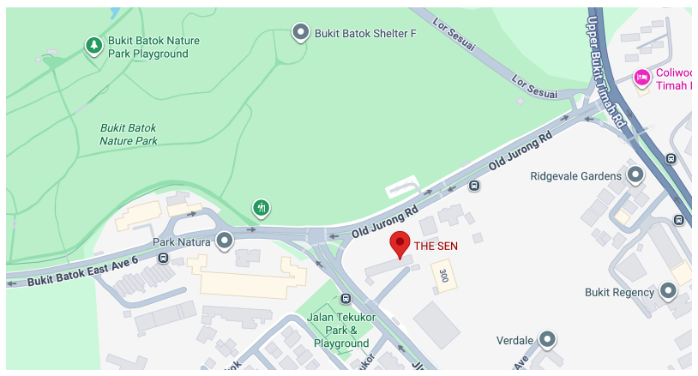

Buyers who prefer boutique living and exclusivity in a smaller development, where lower density often translates into a stronger sense of community and privacy. Nestled in Jalan Jurong Kechil within District 21, The Sen benefits from its Bukit Timah fringe location, which offers access to lifestyle amenities, greenery, and reputable schools. Its boutique size positions it differently from the larger October launches, catering to buyers who favour intimacy over scale.

Importantly, as part of the land tender requirements, URA mandated the inclusion of an early childhood development centre spanning at least 5,382 sq ft - ensuring that this project will feature such a facility, adding practical value for young families. On top of that, its proximity to Bukit Batok Nature Park and Bukit Timah Nature Reserve makes it ideal for family weekend activities, enhancing its lifestyle appeal.

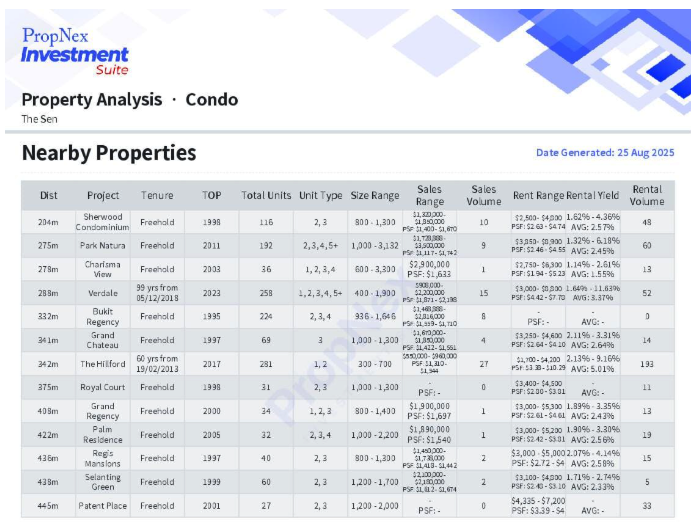

Looking at nearby projects offers useful perspectives for gauging The Sen's potential value. Verdale, for example, last transacted in 2024 at $2,070,000, up from $1,720,000 in 2020, while Park Natura changed hands in August at $2,320,000, rising from $1,510,000 in 2016. Sherwood Condominium, though an older freehold option, continues to hold value between $1,790,000 and $1,850,000.

These benchmarks reveal clear capital appreciation across the Bukit Timah fringe, with rental yields averaging around 1.5% to 5% across the submarket. For buyers, this suggests that The Sen, as a newer boutique RCR project, could benefit from both the upward momentum in prices and steady rental demand. In other words, while it is more intimate in scale compared to mega-developments, the data points highlight why The Sen could offer a sweet spot of exclusivity, long-term growth, and lifestyle appeal.

Instead of cannibalising each other, these launches could actually spark broader interest and momentum in the market. Buyers who miss out on one project may pivot to another nearby, turning October into a month of choice rather than conflict.

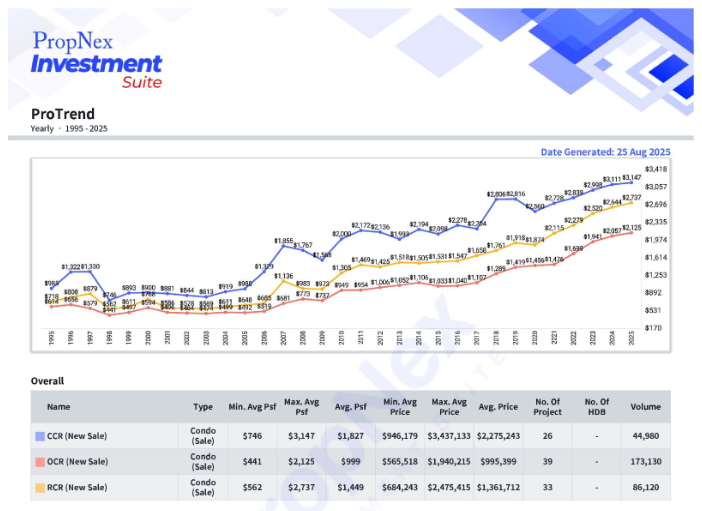

The risk is clear: oversupply in a short window. Developers might be pressured to tweak pricing or roll out early-bird incentives. But Singapore's property market has a history of resilience - when demand is strong, even multiple launches can enjoy healthy sales. Long-term data reinforces this: according to PropNex ProTrend, the average PSF for new condo sales has climbed from just $708 psf in 1995 to over $2,476 psf in 2025.

It is worth noting, however, that PSF alone is not always the best gauge of a condo's value - especially following the harmonisation rule, which standardises floor area measurements. This means that comparisons across projects or eras must also consider overall unit size, layout efficiency, and quantum, not just PSF figures in isolation.

Regionally, CCR prices have reached an average of $2,275,243 (with highs above $3,400,000), RCR at $1,361712, and OCR at $995,399. This steady upward trajectory, despite cyclical dips, suggests that demand has consistently absorbed new supply over the decades, with each region steadily pushing new benchmarks. The real decider for October will be how well each project is priced relative to its location and target audience.

If there's one project to watch, it's Zyon Grand. Its scale, prime D3 location, and proximity to the TEL give it strong visibility and proven rental appeal. Personally, I believe Zyon Grand has the makings of October's headline success story - it combines the draw of central living with the assurance of rental demand, while its larger scale means facilities will rival those of established icons. For buyers, it feels like a rare chance to secure a centrally located home with both lifestyle convenience and investment potential baked in, and that dual appeal could very well see it lead the pack.

That said, Penrith could surprise - Margaret Drive projects have shown steady capital appreciation, making it a safe and attractive choice for families. Skye at Holland will likely appeal to prestige buyers who value CCR exclusivity, while The Sen stands out for those seeking boutique-scale living with Bukit Timah's lifestyle advantages. Faber Residences, though smaller, could carve a niche as a more affordable OCR entry point, offering good value for upgraders priced out of central districts.

So, can the market absorb so many launches in October? The answer: most likely yes - but not all projects might shine equally. Buyers today are selective, and success will boil down to a mix of pricing strategy, project positioning, and buyer fit. One thing's for sure: October's launch showdown will set the tone for how the property market closes out 2025.

Views expressed in this article belong to the writer(s) and do not reflect PropNex's position. No part of this content may be reproduced, distributed, transmitted, displayed, published, or broadcast in any form or by any means without the prior written consent of PropNex.

For permission to use, reproduce, or distribute any content, please contact the Corporate Communications department. PropNex reserves the right to modify or update this disclaimer at any time without prior notice.